QuickBooks Online and Returned Customer Payments

Feb 20, 2023Let’s say you invoice a customer for services and, even though it’s 2023 and there are much faster and more secure ways to pay, your customer pays you with a good old fashioned check!

This means you deposited the check and the funds were credited to your account, and some time later the bank notified you of the NSF and took the money back.

And let’s assume you were charged a $20 fee.

How do you record the returned customer payment in QuickBooks Online?

The first thing to bear in mind is that the customer now owes you the money again.

The second thing is, you’ve already recorded the income with the original invoice, so you don’t want to invoice the customer again. Not for that, anyway.

The third thing you want to keep in mind is that you want that receivable aging from the date of the original invoice. They shouldn’t have their aging shortened just because they bounced their check.

Now, everyone whom I have ever seen teach this has taught it based on the use of a Product Or Service called, “NSF” to record the funds when they are taken out of your account. This means that you would need a separate product or service for each bank account where this might happen, because that product or service needs to be linked to its respective bank account.

I have a better way!

With my method you are only ever going to need one NSF Service Item. And the rest is super simple and straightforward.

You’ll need a clearing account. Let’s call it, “Cash and Checks Clearing,” and set it up as a Bank Account.

Now we’ll record the payment that the bank took out when the check was returned. For this you will simply create a new “Expense” to record the payment out of your checking account.

In this case, it will be for $7,520.00 to include the $20 charge. Most banks will take these out in two separate payments.

The $7,500 payment gets booked to Cash and Checks Clearing, as follows:

Click for a larger image:

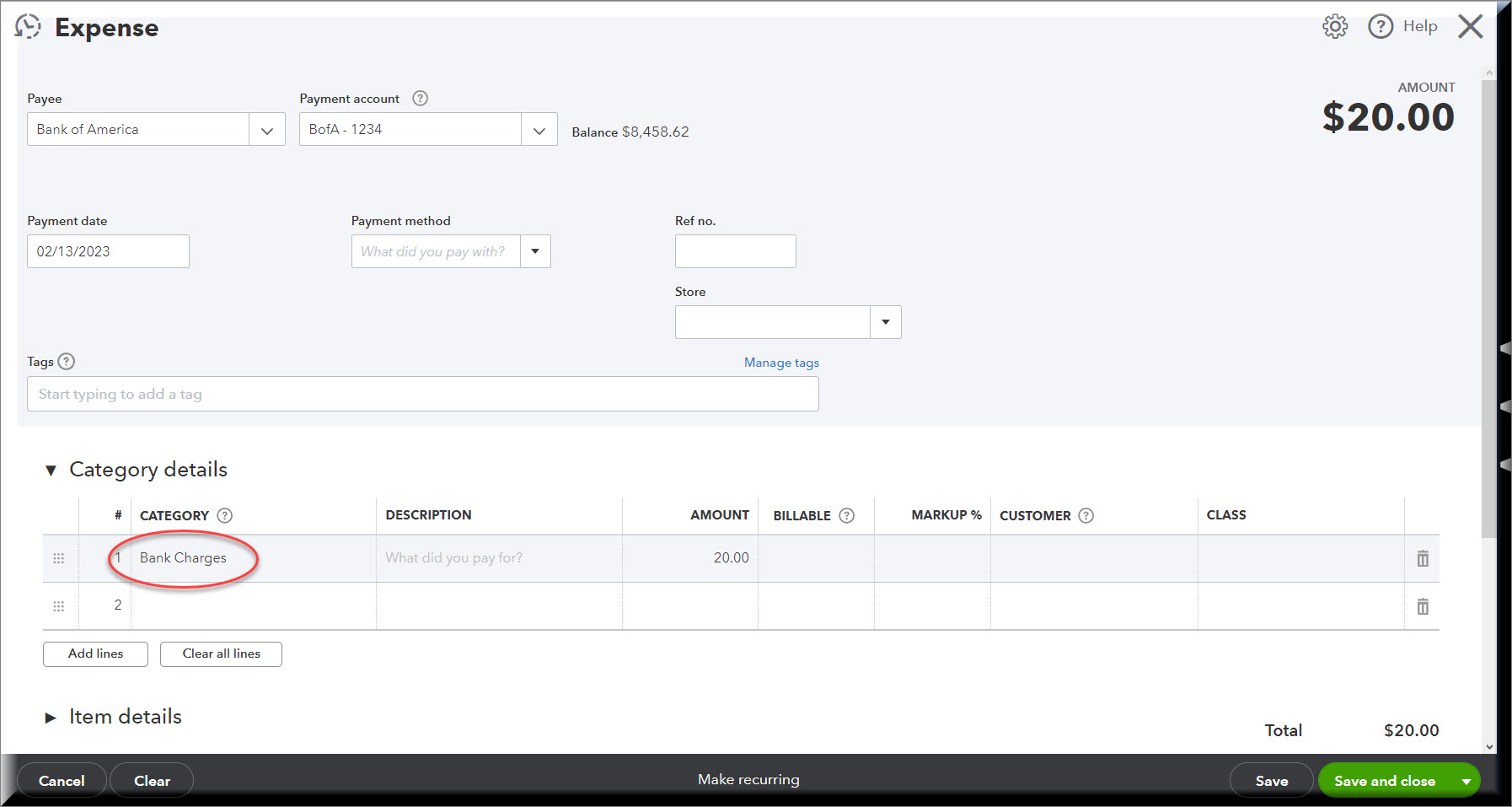

Then book the $20 fee that was taken out and code it to Bank Charges:

At this point, your bank account is perfectly up to date:

Now we have to get our money from the client, and get reimbursed for the bank fee, plus $5 for our troubles.

Did you know that in some states (like mine) you can actually sue someone for a bounced check for up to THREE TIMES the amount?

We’re going to invoice the client, but not for the service items we would have used in the original invoice. That would duplicate the income, and that is what we want to avoid.

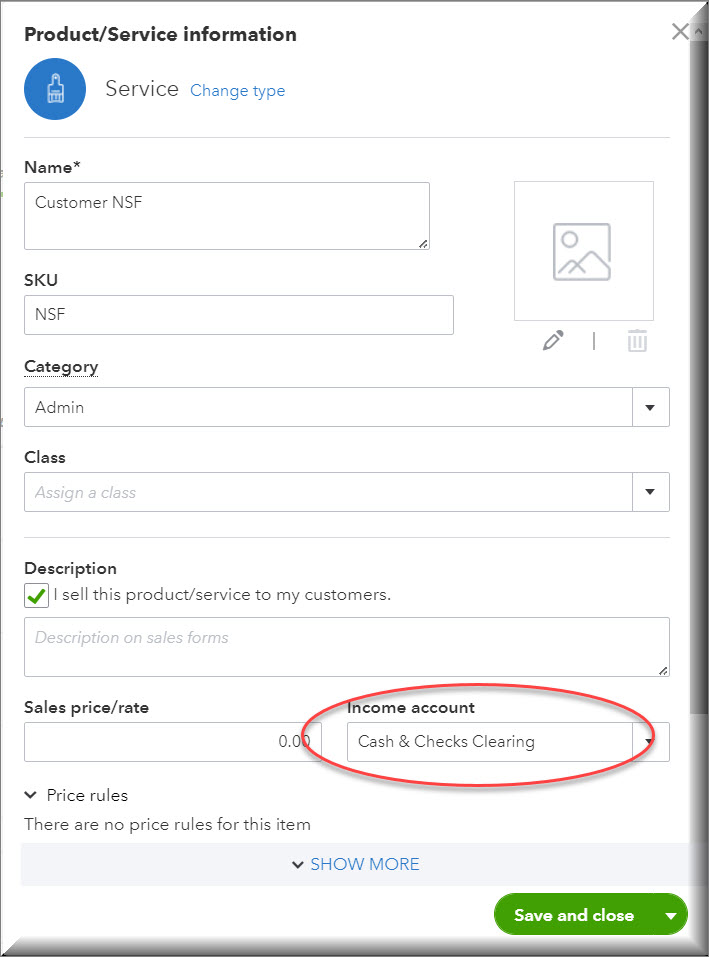

Instead, we’re going to use that NSF Service Item I talked about for the $7,500. And we’ll map it to the Cash and Checks Clearing account. And we’ll add an item for Bank Fees, mapped to a reimbursed expenses (Income) account so we can charge them $25.

First, let’s create the Product called “Customer NSF”.

Now we can record the invoice, and then we’re all done!

First, check the original invoice for the date. We’ll want to date this one on the exact same day to get the “aging” right.

The bank fee reimbursement product is mapped to the reimbursed expenses income account.

Here’s what cash and checks clearing looks like now – as you’ll see it zero’s out perfectly:

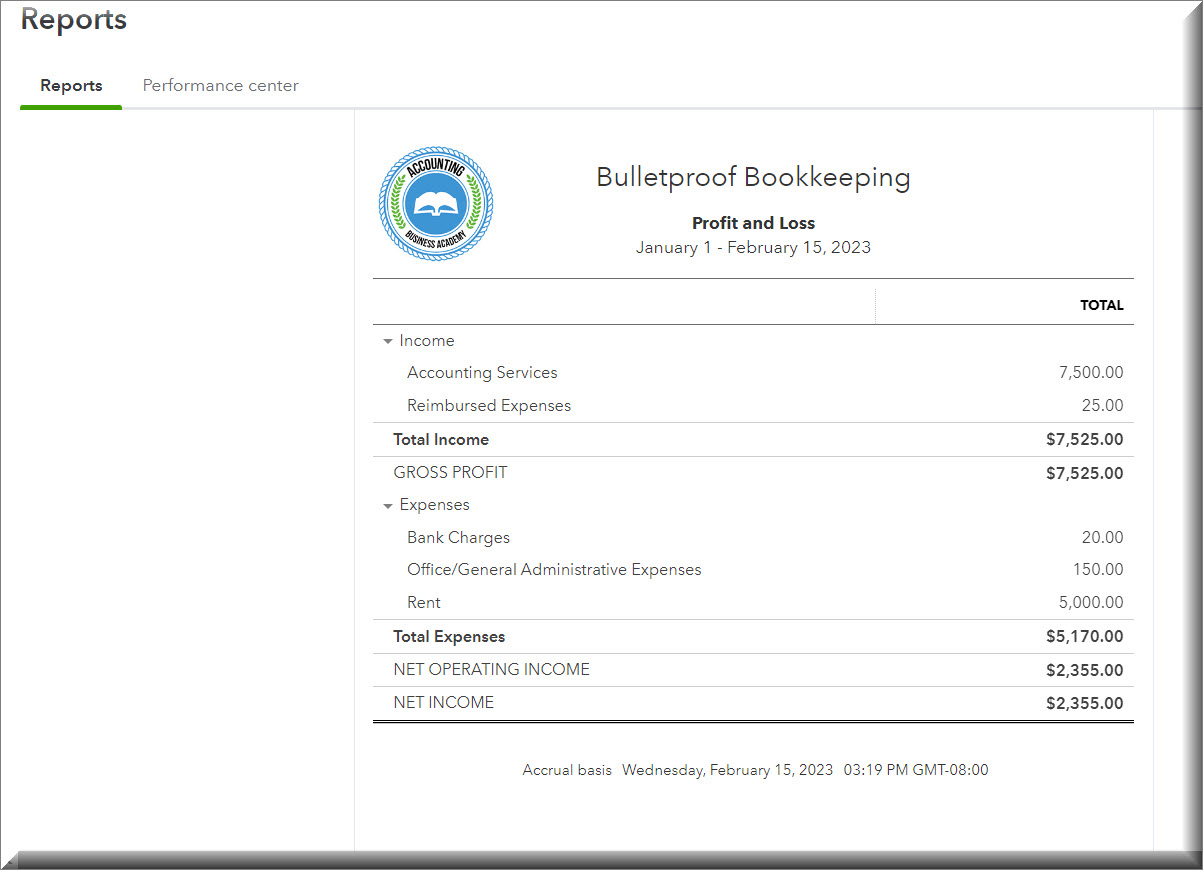

And a look at the Income Statement confirms we have the original $7,500 of income and the $25 in reimbursed expenses.

Why this is bulletproof:

- We dealt with the money that got returned by the bank along with the fee we paid. This will reconcile perfectly in the bank.

- We put the customer’s balance back on the books at the original date of the invoice which keeps the aging right – it’s as if the customer never paid at all.

- We handled the reimbursement of the bank fee as an income item so we didn’t wind up with a negative expense because we charged more than we were charged.

- With this process, we will only ever need the one NSF product no matter which bank account this happens with.

- For bonus points: as an improvement on the method everyone else teaches, you don’t wind up with an “Invoice” in a bank account the way you would if you used an NSF Product that was mapped to your bank account. I personally hate seeing stuff like that in a set of books.

- Life is good!

That’s all folks!

Got questions? Jump into my Guide To The Galaxy Community and you’ll find a channel for this very article.

And if you liked the use of the clearing account on this one, you don't want to miss this other recent video:

The Curious Uses of Clearing Accounts With QuickBooks Online

READY FOR BLAST OFF?

Hop On 'Nerd's Guide to the Galaxy' and Experience the Ultimate in FREE Coaching, Resources and Training...

- Live workshops, trainings and recordings

- An intimate community of like-minded people

- A FREE course (and you choose your interest)

- Preferred access to my inner circle

- A Free subscription to my newsletter "Nerd's Words"

- Blog Post Notifications

- And MUCH MORE!

We hate SPAM. We will never sell your information, for any reason.